Automated Underwriting: Streamlining the Lending Process

Understanding Automated Underwriting

Automated underwriting, a crucial component of AI for credit risk assessment, leverages sophisticated algorithms and data analysis to automate the traditional loan application process. This technology streamlines the entire lending cycle, from initial application to final approval, by swiftly evaluating creditworthiness and risk. By processing vast amounts of data, automated underwriting systems can identify patterns and make predictions that significantly expedite the decision-making process.

The core function of automated underwriting is to make lending decisions more efficiently and objectively. This process removes a considerable amount of human bias and subjective judgment, leading to more consistent and equitable lending practices.

The Role of AI in Credit Risk Assessment

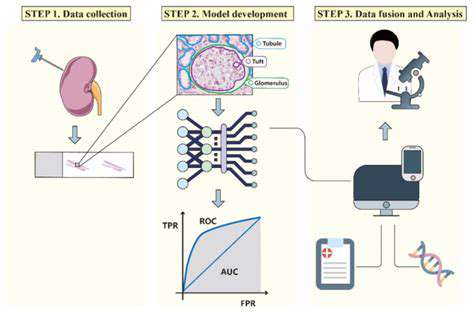

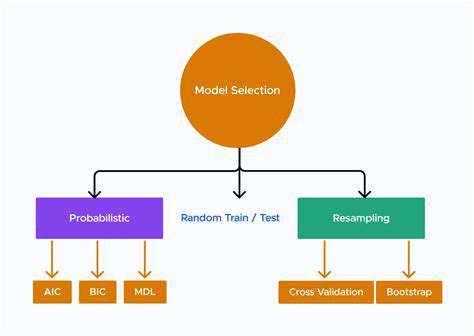

Artificial intelligence (AI) plays a pivotal role in automated underwriting by enabling sophisticated credit risk assessment. AI algorithms are trained on massive datasets encompassing various factors, such as credit history, income, employment stability, and even social media activity. By identifying complex patterns and relationships within this data, AI can predict the likelihood of loan default with greater accuracy than traditional methods.

This enhanced predictive capacity enables lenders to make more informed decisions, reducing the risk of loan defaults and improving overall portfolio health.

Benefits of Automated Underwriting

Automated underwriting offers a multitude of benefits, including significant time savings for both lenders and borrowers. The speed and efficiency of the automated process drastically reduce the time it takes to process loan applications, allowing for quicker approvals and funding.

Furthermore, automated underwriting can lead to increased loan volume, as lenders can process more applications in a shorter period. This increased throughput is vital for meeting market demands and ensuring a robust lending ecosystem.

Data Sources for AI-Driven Underwriting

AI-driven automated underwriting relies heavily on diverse data sources. These include traditional financial data like credit reports, income verification, and payment history. However, AI algorithms can also incorporate alternative data sources, such as social media activity, online shopping behavior, and even publicly available information about a borrower's location.

The use of these alternative data sources allows for a more holistic view of the borrower, potentially uncovering insights that might have been missed by traditional methods, and providing a more comprehensive risk assessment.

Improving Lending Efficiency and Accuracy

A major advantage of automated underwriting is its ability to significantly improve the efficiency of the lending process. By automating tasks that were previously handled manually, lenders can reduce operational costs and free up valuable resources for other activities.

Further, automated systems often exhibit superior accuracy in credit risk assessment compared to human underwriters. Their ability to process vast quantities of data and identify complex patterns minimizes errors and increases the precision of loan decisions.

Addressing Ethical Concerns in AI-Driven Lending

While automated underwriting offers significant benefits, it's essential to address potential ethical concerns. Bias in the data used to train AI algorithms can inadvertently perpetuate existing societal inequalities in lending practices. Careful consideration and mitigation strategies are crucial to ensure equitable access to credit for all.

The Future of Automated Underwriting

The future of automated underwriting is promising, with continuous advancements in AI and machine learning technologies. As these technologies evolve, the ability to incorporate more complex data sources and refine risk assessment models will further enhance the accuracy and efficiency of the lending process.

This evolution will likely lead to even more personalized and tailored lending options, better serving the needs of a diverse range of borrowers while maintaining responsible lending practices.

Challenges and Considerations

Understanding the Scope of the Challenges

One of the primary challenges in any endeavor is accurately assessing the scope of the issues involved. This often involves a thorough analysis of the current situation, identifying all potential obstacles and limitations. Failure to fully understand the scope can lead to inadequate planning and ultimately, project failure. A detailed breakdown of the problem is crucial for developing effective strategies to overcome it.

Resource Allocation and Management

Effective resource management is paramount to tackling any challenge successfully. This encompasses not only financial resources but also human capital, technology, and time. Careful planning and allocation of resources can significantly impact the project's feasibility and success rate. Proper allocation ensures that resources are utilized efficiently and effectively to meet the project's objectives.

Risk Assessment and Mitigation

Risk assessment is an essential part of any project planning process. It involves identifying potential risks, evaluating their likelihood and impact, and developing strategies to mitigate them. Proactive risk management is key to minimizing potential disruptions and ensuring project continuity. This process also helps in developing contingency plans to address unexpected events.

Stakeholder Engagement and Communication

Successful projects often rely on strong stakeholder engagement and effective communication. Understanding the needs and concerns of all stakeholders is vital for building consensus and ensuring buy-in. Clear and consistent communication throughout the project lifecycle is essential to keep stakeholders informed and address any concerns promptly. Transparent communication fosters trust and collaboration, which are crucial for overcoming obstacles.

Time Management and Prioritization

Effective time management is critical to staying on track and meeting deadlines. Prioritizing tasks and allocating sufficient time for each step in the project is crucial for success. Poor time management can lead to delays and missed deadlines, ultimately impacting the project's overall outcome. Establishing realistic timelines and breaking down larger tasks into smaller, manageable steps is essential for effective time management.

Adaptability and Flexibility

Unforeseen circumstances and challenges often arise during any project. The ability to adapt and adjust plans as needed is crucial for success. Flexibility allows for navigating unexpected obstacles and ensuring that the project stays on course despite unforeseen challenges. Adapting to changing conditions demonstrates a proactive approach and a commitment to achieving the desired outcome.

Continuous Evaluation and Improvement

Continuous evaluation and improvement are crucial for optimizing the project's effectiveness and efficiency. Regular assessments throughout the project lifecycle allow for identifying areas for improvement and adjustments to strategies. Monitoring progress against established goals and objectives ensures that the project remains aligned with its initial vision. Regular feedback loops and process reviews are vital for continuous learning and improvement. This process fosters a culture of continuous development and improvement.