The Current Hurdles in Cross-Border Supply Chain Payments

International Payment Infrastructure Limitations

Cross-border supply chain payments often face significant hurdles due to the complexity of international payment infrastructure. Different countries have varying regulations, payment systems, and currencies, leading to delays, high transaction costs, and increased risk. These challenges can significantly impact businesses operating across borders, hindering efficient cash flow and impacting profitability. International banks, while crucial, can sometimes prove insufficient in streamlining these processes, potentially leading to bottlenecks and inefficiencies.

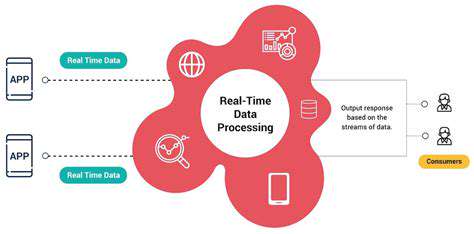

The legacy systems used for international payments are often inflexible and lack the real-time transparency needed for modern supply chains. This makes it difficult to track funds and resolve disputes, potentially leading to costly errors and delays. The lack of standardized processes and communication protocols across different financial institutions further exacerbates these difficulties, creating a complex and often opaque environment for businesses.

Currency Fluctuation and Exchange Rate Risks

One of the most significant challenges in cross-border supply chain payments is the volatility of currency exchange rates. Fluctuations in exchange rates can lead to substantial losses for businesses, particularly those with long payment cycles or large transactions. The uncertainty associated with these fluctuations can make it challenging to accurately predict costs and manage financial risks effectively.

Predicting and mitigating these risks requires sophisticated financial tools and expertise. Businesses often rely on hedging strategies or forward contracts to protect themselves from adverse currency movements. However, these strategies can be complex and costly, adding further complexity to an already intricate process.

Security Concerns and Fraudulent Activities

The inherent security risks associated with cross-border transactions are a critical concern for businesses involved in international supply chains. The transfer of funds across borders makes companies susceptible to various types of fraud, from scams targeting payment details to more sophisticated attacks involving organized crime. Protecting sensitive financial data and ensuring secure payment channels are paramount to maintaining trust and preventing costly losses.

The complex nature of international transactions can create blind spots in security protocols. Identifying and preventing fraudulent activities requires advanced security measures, including robust encryption, multi-factor authentication, and real-time monitoring systems. Maintaining vigilance and adapting to emerging threats are essential to mitigating these risks effectively.

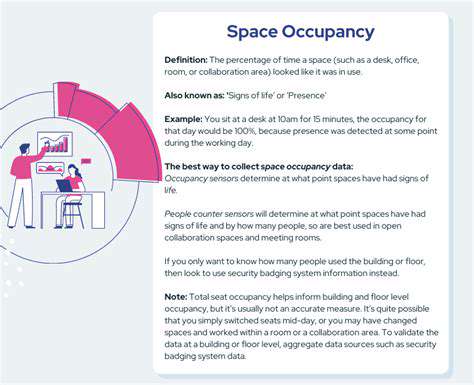

Lack of Transparency and Traceability

Lack of transparency in cross-border supply chain payments can hinder efficient operations and create challenges in resolving disputes. The multiple intermediaries involved in the process and the often opaque nature of international payment systems can make it difficult to track funds in real-time. This lack of visibility can lead to delays in payments, errors in reconciliation, and difficulties in identifying and resolving issues.

A lack of traceability can also pose significant challenges in auditing and compliance. Businesses need detailed records of transactions and payments to comply with various regulations and ensure accountability. Without adequate transparency and traceability, it can be difficult to maintain accurate financial records and meet regulatory requirements.

Blockchain's Potential to Streamline the Process

Blockchain's Transparency and Immutability

Blockchain's inherent transparency, achieved through its distributed ledger system, offers significant advantages in streamlining various processes. Every transaction is recorded publicly and immutably, meaning it cannot be altered or deleted after being added to the chain. This characteristic enhances trust and accountability, particularly in industries like supply chain management where provenance and authenticity are crucial.

This inherent immutability is a powerful tool for combating fraud and errors. It provides a tamper-proof record of all transactions, making it significantly harder to manipulate data or cover up discrepancies. This is especially valuable in industries where trust and reliability are paramount.

Enhanced Security and Data Integrity

The decentralized nature of blockchain significantly bolsters data security. By distributing the ledger across multiple nodes, it becomes incredibly difficult for a single entity to compromise the entire system. This decentralized architecture mitigates the risk of single points of failure and enhances the overall resilience of the system.

This robust security framework is particularly beneficial in sensitive applications where data integrity is critical. The cryptographic hashing algorithms used in blockchain technology ensure that any attempt to alter data will be immediately detectable, safeguarding against unauthorized modifications and maintaining the integrity of the information recorded on the chain.

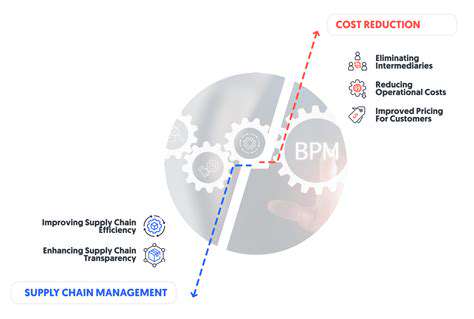

Improved Efficiency and Reduced Costs

Blockchain's automated processes can significantly streamline operations by eliminating intermediaries and automating tasks. This efficiency translates into substantial cost savings for businesses, reducing administrative overhead and transaction fees. For example, in financial transactions, the elimination of intermediaries can significantly reduce processing time and costs.

Automating processes through blockchain technology leads to significant gains in efficiency and cost reduction. This efficiency is achieved by automating tasks and removing redundant steps, leading to faster processing times and lower operational costs overall. The elimination of intermediaries also leads to reduced transaction fees.

Streamlined Supply Chain Management

Blockchain technology offers a robust solution for streamlining supply chain management by providing a transparent and auditable record of every stage in the process. From origin to delivery, every step can be tracked and verified, enhancing transparency and accountability across the entire supply chain. This fosters greater trust among stakeholders and allows for improved traceability of products.

Revolutionizing Financial Transactions

Blockchain's potential to revolutionize financial transactions is undeniable. The technology facilitates faster, cheaper, and more secure cross-border payments by eliminating intermediaries and automating the process. This can significantly reduce transaction times and costs, benefiting both businesses and individuals alike. This increased efficiency is especially advantageous in international trade.

The potential for faster and more secure international transactions is a major advantage. Blockchain technology simplifies and accelerates these transactions, allowing for faster processing times and reduced risks of fraud.

Potential Applications in Diverse Industries

Beyond finance and supply chain management, blockchain's applications extend to various industries, including healthcare, voting systems, and intellectual property rights management. By providing a secure and transparent platform for recording and managing data, blockchain facilitates trust and accountability in these sectors. This potential extends to many other industries as well.

The versatility of blockchain technology positions it as a powerful tool for transforming various industries. Its ability to enhance security, transparency, and efficiency makes it a game-changer across a multitude of sectors.

Future Applications and Adoption of Blockchain in Supply Chain Payments

Decentralized Payment Systems

Blockchain's potential to revolutionize supply chain payments lies in its ability to create decentralized systems. These systems eliminate the need for intermediaries like banks, significantly reducing transaction costs and processing times. This decentralization fosters transparency and trust among all participants in the supply chain, from producers to retailers, enhancing accountability and reducing the risk of fraud. Imagine a world where payment confirmations are instantaneous and verifiable by all parties involved, without relying on a central authority—this is the promise of blockchain in supply chain payments.

Enhanced Transparency and Traceability

Blockchain's inherent transparency allows for a comprehensive audit trail of every transaction within the supply chain. This detailed record of goods movement, payment details, and other relevant information is easily accessible to all authorized parties. This enhanced transparency streamlines dispute resolution by providing clear and verifiable records, reducing delays and improving trust among participants. Ultimately, this increased traceability fosters greater accountability and reduces the likelihood of discrepancies or errors in the supply chain.

Improved Security and Reduced Fraud

Blockchain's cryptographic security features provide unparalleled protection against fraud and tampering. The immutable nature of the ledger makes it virtually impossible to alter or delete transaction records, ensuring the integrity of payment data. This robust security framework not only safeguards sensitive financial information but also prevents unauthorized access and manipulation, significantly reducing the risk of fraudulent activities within the supply chain. This enhanced security is a critical factor in building trust and confidence in the system.

Streamlined Processes and Reduced Costs

By automating and digitizing payment processes, blockchain can streamline operations and reduce costs across the entire supply chain. The elimination of intermediaries and manual processes translates to significant savings in transaction fees and administrative expenses. Automated settlements and real-time tracking of goods and payments further accelerate the flow of goods and reduce delays, leading to greater efficiency and improved profitability for all participants. The potential cost savings are substantial and can be a major driver for adoption.

Faster Payment Settlement Times

Blockchain technology enables near-instantaneous payment settlements, significantly reducing the time it takes for payments to be processed and confirmed. This speed is a critical factor in optimizing cash flow and improving the overall efficiency of the supply chain. The elimination of delays associated with traditional banking processes leads to quicker turnaround times and improved responsiveness to market demands. This acceleration in payment settlement times is a major advantage for businesses seeking to optimize their supply chain operations.

Increased Efficiency and Productivity

The automation features of blockchain platforms increase the overall efficiency of supply chain operations. By automating tasks such as record-keeping, tracking, and payment processing, businesses can free up valuable resources and dedicate them to other strategic initiatives. This increased efficiency translates directly into higher productivity and improved output. The streamlined workflows reduce manual intervention, leading to fewer errors and a more predictable and reliable supply chain process. This boost in efficiency is a significant factor in attracting businesses to adopt blockchain technology.