Predicting Market Trends with Machine Learning Models

Understanding Market Sentiment

Analyzing market sentiment, the collective emotional tone expressed by investors and traders, is crucial for predicting future price movements. This emotional response often precedes significant market shifts, creating valuable insights for informed decision-making. Sentiment analysis, a technique using natural language processing and machine learning, can decipher the underlying emotions in news articles, social media posts, and financial discussions, providing a more nuanced understanding of market sentiment compared to traditional methods.

Machine learning algorithms excel at identifying patterns and correlations in massive datasets, enabling the identification of subtle shifts in sentiment that might be missed by human analysts. This allows for a proactive approach to market forecasting, enabling financial professionals to capitalize on potential opportunities or mitigate potential risks.

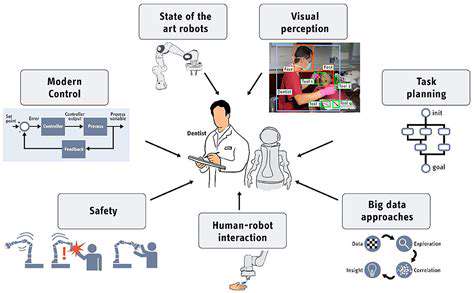

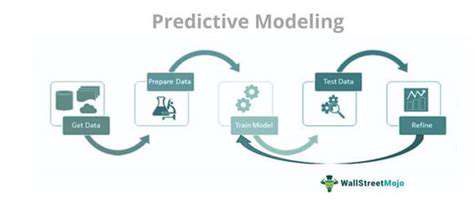

Developing Machine Learning Models

Creating effective machine learning models for predicting market trends requires careful consideration of various factors. Data preprocessing, including cleaning, transforming, and feature engineering, is critical to ensure the model's accuracy and reliability. Choosing the right algorithm—whether it's a support vector machine, a neural network, or a random forest—depends on the specific characteristics of the data and the desired outcome.

Feature selection is paramount. Selecting the most relevant features from the vast dataset of market indicators, news sentiment, and social media activity is essential for achieving optimal performance and reducing the risk of overfitting. This careful selection process can lead to a model that accurately identifies and leverages the most important market signals.

Data Acquisition and Preparation

Gathering high-quality and comprehensive market data is essential for training robust machine learning models. This involves collecting data from diverse sources, including financial news outlets, social media platforms, and market data providers. The data must be thoroughly cleaned and prepared for modeling, addressing missing values, outliers, and inconsistencies to ensure that the model is trained on accurate and reliable information.

Data preparation is a crucial step, often consuming a significant portion of the overall project time. This step ensures that the data is in a suitable format for the chosen machine learning algorithm, maximizing the model's effectiveness and preventing errors that could lead to inaccurate predictions.

Model Evaluation and Validation

Evaluating the performance of a machine learning model for market prediction is critical to ensuring its reliability and validity. Metrics like accuracy, precision, recall, and F1-score are crucial for assessing the model's ability to correctly classify market trends. Splitting the data into training, validation, and testing sets allows for a robust assessment of the model's performance on unseen data, preventing overfitting and ensuring generalizability.

Rigorous validation is essential to avoid overfitting, a common pitfall in machine learning. Overfitting occurs when the model learns the training data too well, leading to poor performance on new, unseen data. By using validation techniques, we can identify and address this issue, ensuring the model's accuracy on future market predictions.

Real-World Applications and Case Studies

Machine learning models can be applied to various financial tasks, including stock price prediction, portfolio optimization, and risk management. Real-world case studies demonstrate the practical application of these models in diverse market scenarios, showcasing their potential to generate valuable insights and improve decision-making.

Analyzing historical market data, incorporating news sentiment, and using machine learning algorithms to predict market trends can provide a competitive advantage for financial institutions. The successful implementation of these models requires a deep understanding of the financial markets and the appropriate application of machine learning techniques.

Future Directions and Challenges

The field of using machine learning for predicting market trends is constantly evolving, with ongoing research focusing on enhancing model accuracy and incorporating new data sources. Addressing challenges such as data bias, model interpretability, and the need for continuous learning is crucial for achieving greater reliability and robustness.

Further research into incorporating alternative data sources, like social media sentiment, along with traditional financial data, is expected to enhance the accuracy and effectiveness of market prediction models. This continuous development and refinement of methodologies will be crucial for navigating the complexities of the modern financial landscape.

The Future of AI in Financial Market Prediction

AI's Potential for Enhanced Accuracy in Prediction

Artificial intelligence (AI) algorithms, particularly machine learning models, have the potential to significantly enhance the accuracy of financial market predictions. By analyzing vast datasets of historical market data, economic indicators, news articles, and social media sentiment, AI can identify complex patterns and relationships that might be missed by human analysts. This ability to process information at scale and identify subtle correlations leads to more sophisticated and potentially more accurate predictions, which can have a profound impact on investment strategies and risk management.

The Role of Machine Learning in Sentiment Analysis

Machine learning plays a crucial role in analyzing financial market sentiment. By training algorithms on massive datasets of textual data, such as news articles and social media posts, AI can identify underlying emotional tones and opinions regarding specific market instruments or economic events. This sentiment analysis allows AI systems to gauge market sentiment more effectively than traditional methods, providing valuable insights into potential market fluctuations and predicting investor behavior with greater precision. This ability to understand and predict investor sentiment is key to anticipating market movements.

Improving Risk Management Through AI-Powered Models

AI can revolutionize risk management in financial markets by developing sophisticated models that identify and quantify potential risks more effectively. These models can analyze various factors, including market volatility, economic indicators, and historical data, to predict potential losses and develop strategies to mitigate them. By providing more accurate risk assessments, AI-powered models can reduce the likelihood of significant financial losses and enhance the overall stability of the financial system.

Addressing Challenges of Bias and Data Integrity

While AI holds immense promise, it's crucial to address the potential challenges associated with bias and data integrity. AI models are only as good as the data they are trained on. If the training data contains biases, the resulting models may perpetuate or even amplify those biases, leading to inaccurate or unfair predictions. Ensuring the quality and integrity of the data is paramount to building reliable and unbiased AI models for financial market prediction. Careful data curation and validation are essential steps in mitigating this risk.

The Integration of AI with Traditional Financial Tools

The future of AI in financial markets likely lies in integrating AI-powered tools with existing financial instruments and methodologies. Instead of replacing traditional methods entirely, AI can augment them, providing additional insights and predictive capabilities. Integrating AI into existing financial platforms can enhance the decision-making process for investors and financial institutions, leading to more informed and strategic investment choices. This integration will be crucial to maximizing the benefits of AI in the financial sector.

Ethical Considerations and Regulatory Frameworks

As AI becomes more prevalent in financial market prediction, ethical considerations and regulatory frameworks become increasingly important. Issues such as algorithmic transparency, accountability, and potential misuse of AI-powered tools need careful consideration. Establishing clear guidelines and regulations for the development and deployment of AI in finance will ensure responsible innovation and prevent potential harm. This includes ensuring fairness, avoiding discrimination, and promoting transparency in the use of AI-powered tools in financial decision-making processes.