Introduction to AI-Powered Algorithmic Trading

Defining Algorithmic Trading

Algorithmic trading, also known as automated trading, involves using computer programs to execute trades based on pre-defined rules and strategies. These rules can range from simple market conditions to complex mathematical models, enabling traders to act quickly and efficiently in response to changing market dynamics. This automated approach significantly reduces human emotional bias and potential errors in decision-making, leading to potentially more consistent performance.

The Role of AI in Algorithmic Trading

Artificial intelligence (AI) is revolutionizing algorithmic trading by introducing sophisticated learning capabilities. AI algorithms can analyze vast quantities of market data, identify patterns, and make predictions with a level of accuracy previously unattainable. This allows for the development of more sophisticated and adaptive trading strategies, which can react to market fluctuations in real-time with greater precision.

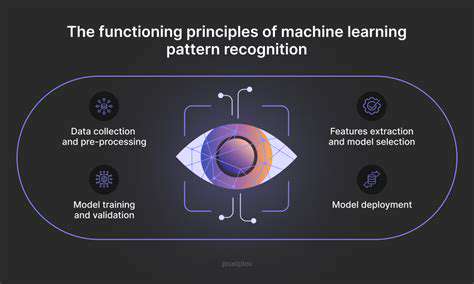

Data Analysis and Pattern Recognition

AI excels at processing and analyzing massive datasets from various sources, including historical market data, news articles, social media sentiment, and economic indicators. This analysis allows AI systems to identify complex patterns and correlations that might be missed by human traders. The ability to recognize these patterns is crucial for generating profitable trading signals and adapting to evolving market conditions.

Machine Learning in Algorithmic Strategies

Machine learning (ML), a subset of AI, plays a pivotal role in developing sophisticated algorithmic trading strategies. ML algorithms can learn from historical data, identify profitable trading opportunities, and optimize strategies over time. This adaptive learning process allows AI-powered trading systems to continuously improve their performance and react to market changes with greater agility.

Backtesting and Optimization

A crucial aspect of AI-powered algorithmic trading is the ability to rigorously backtest strategies on historical data. AI algorithms can simulate various market scenarios and evaluate the performance of different strategies in diverse market conditions. This meticulous backtesting process allows traders to optimize parameters and refine strategies before deploying them in live trading environments. This process is essential for minimizing risks and maximizing potential returns.

Risk Management and Mitigation

AI can play a significant role in enhancing risk management within algorithmic trading strategies. AI algorithms can analyze market volatility, identify potential risks, and adjust trading positions accordingly. This proactive risk management approach can help mitigate potential losses and protect capital in turbulent market conditions. By constantly monitoring risk factors, AI can make adjustments to trading strategies in real-time, safeguarding investments.

Ethical Considerations and Regulation

The increasing use of AI in algorithmic trading raises important ethical considerations, including the potential for bias in algorithms and the need for transparent decision-making processes. Regulations and guidelines are crucial to ensure responsible development and deployment of AI-powered trading systems. Maintaining ethical standards and compliance with regulations will be essential to prevent potential market manipulation and maintain trust within the financial markets.

Backtesting and Optimization with AI

Backtesting Fundamentals

Backtesting is a crucial step in the investment process, allowing traders and investors to evaluate the performance of a trading strategy or model on historical data. It's essentially a dry run to see how a strategy would have performed in the past. This analysis helps identify potential strengths and weaknesses of the strategy before deploying it in live trading. Understanding the nuances of the backtesting process is critical for developing robust and profitable trading strategies. This involves careful consideration of the data used, the specific trading rules implemented, and the metrics employed to assess performance.

A thorough backtest should use a representative historical dataset, covering a period that is relevant to the strategy and market conditions. The accuracy and appropriateness of the data used will directly impact the reliability of the results. Data manipulation or bias in the dataset can lead to inaccurate conclusions and poor strategy evaluation.

Optimization Techniques

Optimization is the process of fine-tuning a trading strategy to maximize its performance or achieve specific desired outcomes. This often involves adjusting parameters or rules within the strategy to improve profitability or risk management. Effective optimization requires a deep understanding of the strategy's components and how they interact. This process can be complex, involving various methodologies to identify the optimal settings.

Several optimization techniques exist, ranging from simple parameter adjustments to more sophisticated algorithms like genetic algorithms or simulated annealing. Each method has its strengths and weaknesses, and the best approach depends on the specific strategy and the desired level of optimization.

Data Considerations in Backtesting

The quality and relevance of the data used in backtesting are paramount. Historical data should accurately reflect the market conditions during the period being analyzed. Inaccurate or incomplete data can lead to misleading results, potentially impacting the reliability of the backtesting outcome. Careful consideration must be given to data frequency, completeness, and potential biases in the dataset.

Data cleansing and preprocessing are often necessary steps to mitigate these issues. This includes identifying and addressing missing values, outliers, and potential data anomalies. Accurate data is essential to ensure the backtesting process yields meaningful and reliable insights.

Metrics for Evaluation

Evaluating the performance of a trading strategy requires the use of appropriate metrics. Common metrics include Sharpe Ratio, Sortino Ratio, Maximum Drawdown, and others. Each metric provides a different perspective on the strategy's risk-adjusted returns and overall performance. Understanding the context and limitations of each metric is vital for interpreting the results accurately.

Furthermore, the choice of metrics depends on the specific goals and objectives of the trading strategy. A strategy focused on maximizing returns might prioritize different metrics than a strategy emphasizing risk management.

Risk Management in Backtesting

Risk management is an integral part of backtesting and optimization. A strategy should be evaluated not only for its profitability but also for its risk characteristics. Identifying potential risks and developing mitigation strategies before deploying the strategy in live trading is crucial. This involves assessing the strategy's vulnerability to market volatility, adverse events, and other potential risks.

Backtesting should include scenarios that simulate adverse market conditions to evaluate the strategy's resilience. This helps determine the strategy's ability to withstand potential losses and maintain profitability in challenging market environments. This includes considering stop-loss orders, position sizing, and other risk management techniques.