A Growing Concern

Insurance fraud remains one of the most pressing challenges facing modern economies today. While insurers bear the immediate financial brunt, the ripple effects extend to consumers and businesses alike. What makes this issue particularly troubling is how sophisticated operations have become, forcing honest customers to shoulder higher premiums. Industry analysts note that fraudulent schemes grow more elaborate each year, outpacing traditional detection methods.

Contemporary fraudsters employ an array of deceptive tactics, from minor exaggerations to full-scale fabrication of incidents. Some create entirely fictional accidents while others manipulate legitimate claims to extract higher payouts. The spectrum ranges from individual opportunists to well-organized criminal networks targeting insurance systems.

Common Fraudulent Schemes

The landscape of insurance fraud includes several persistent patterns. Some policyholders inflate property damage estimates following legitimate incidents, while others submit claims for losses that never occurred. Medical insurance sees particularly creative schemes, including falsified diagnoses and unnecessary treatment billing. More alarmingly, investigators continue uncovering cases where disasters were deliberately engineered to trigger insurance payouts.

Emerging digital threats compound these challenges. Identity theft enables fraudulent policy applications, while sophisticated document forgery supports false claims. Organized crime groups have weaponized these techniques, operating across jurisdictions to exploit systemic vulnerabilities. Their operations demonstrate concerning levels of specialization and coordination.

Economic Consequences

The financial impact of these activities extends far beyond insurance balance sheets. When insurers adjust rates to account for fraud losses, conscientious policyholders effectively subsidize criminal behavior through increased premiums. This creates accessibility challenges, particularly for individuals and small businesses operating with tight budgets.

At an institutional level, sustained fraud pressures underwriting profitability and capital reserves. This financial strain can limit insurers' capacity to innovate or expand coverage options. The broader economic implications become apparent when considering insurance's role in facilitating commerce and protecting assets across industries.

Developing Effective Countermeasures

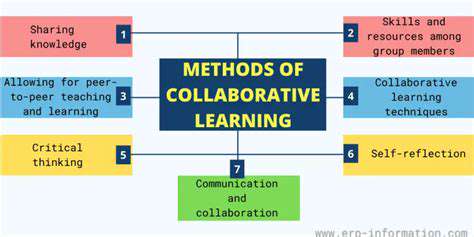

Addressing this multifaceted challenge requires coordinated efforts across multiple fronts. Leading insurers now deploy advanced analytics platforms that scrutinize claims for subtle inconsistencies and behavioral red flags. Regulatory agencies have strengthened collaboration protocols to share intelligence and best practices across jurisdictions.

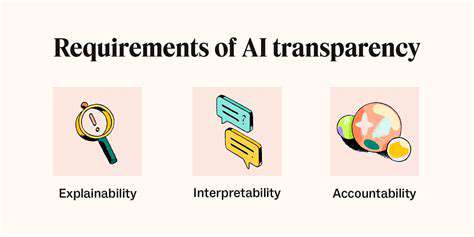

Public education initiatives play a crucial role in prevention by helping consumers recognize and report suspicious activities. This collective approach fosters the transparency and accountability needed to maintain system integrity while protecting stakeholders' financial interests. Successful programs demonstrate that sustained vigilance can significantly reduce fraud prevalence.

Leveraging AI for Advanced Fraud Analytics

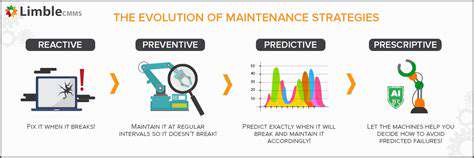

Revolutionizing Detection Capabilities

Modern AI solutions process insurance data with unprecedented precision, identifying complex patterns invisible to conventional systems. These platforms continuously learn from new cases, adapting detection algorithms to emerging fraud tactics. The resulting predictive accuracy helps insurers minimize losses while streamlining legitimate claim processing.

Sophisticated machine learning models detect nuanced indicators like unusual claim clustering, inconsistent documentation patterns, or behavioral anomalies. By analyzing these subtle signals across millions of data points, AI systems achieve detection rates far surpassing manual review processes.

Operational Efficiency Gains

Traditional fraud investigation methods consume substantial time and resources. Intelligent automation handles routine analysis, allowing human specialists to focus on complex cases requiring judgment and expertise. The resulting productivity improvements translate to significant cost reductions and faster claim resolution times.

Processing speed represents another critical advantage. Where manual reviews might take days, AI systems evaluate claims in minutes. This accelerated throughput reduces opportunities for fraudulent activities to escalate while improving service for legitimate policyholders.

Instantaneous Fraud Prevention

Real-time monitoring represents a game-changing capability for digital insurance platforms. AI engines scrutinize transactions as they occur, immediately flagging suspicious activities for review. This proactive stance prevents fraudulent claims from entering payment systems, dramatically reducing financial exposure.

The technology proves particularly valuable in high-volume environments like digital insurance marketplaces. By establishing continuous monitoring protocols, insurers can maintain robust security without compromising user experience or processing speed.

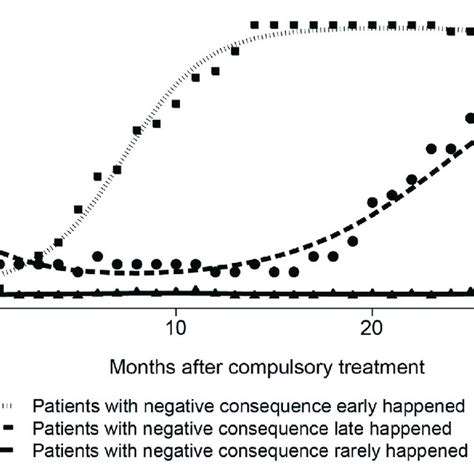

Predictive Risk Modeling

Advanced analytics now enable insurers to anticipate fraud before it occurs. By correlating historical patterns with emerging trends, AI models identify high-risk scenarios and vulnerable processes. This foresight allows for proactive system adjustments and targeted monitoring of potential threat vectors.

Customized Underwriting Solutions

Modern risk assessment tools analyze thousands of variables to develop precise customer profiles. This granular understanding enables fairer pricing models that reflect actual risk exposure rather than broad demographic assumptions. The resulting pricing accuracy benefits both insurers and policyholders while creating natural deterrents to fraudulent behavior. These data-driven approaches foster sustainable market conditions where pricing reflects genuine risk rather than compensating for systemic fraud losses.