Foundations of Distributed Systems

Modern distributed systems operate on principles fundamentally different from traditional hierarchies. Rather than concentrating authority, these networks disperse decision-making across participants. This architectural shift creates more resilient structures where no single point controls the entire system.

Three key characteristics define successful distributed networks: participatory governance, transparent operations, and localized responsiveness. When communities directly influence decisions affecting them, outcomes better reflect collective needs. The resulting systems demonstrate remarkable adaptability to changing circumstances.

Power Distribution in Practice

Effective power distribution requires careful system design. Successful implementations share several common features: multiple validation nodes, consensus mechanisms, and clear governance protocols. These technical elements work together to prevent centralization while maintaining operational efficiency.

Real-world applications show distributed systems thriving in various sectors. Community land trusts demonstrate how local groups can manage resources effectively. Open-source software projects illustrate how decentralized development can produce robust solutions. These examples prove distributed models can outperform traditional hierarchies in specific contexts.

Visibility and Responsibility

Transparent operations form the backbone of trustworthy distributed systems. Unlike opaque centralized institutions, these networks typically record all transactions on publicly verifiable ledgers. This visibility creates natural accountability as participants can audit activities in real-time.

Such transparency fundamentally changes stakeholder relationships. When all actions remain visible, participants naturally align their behavior with network values. This organic accountability often proves more effective than external regulations in maintaining system integrity.

Localized Problem-Solving

Distributed systems excel at addressing hyperlocal challenges. Community-based solutions frequently outperform centralized approaches because local actors possess nuanced understanding of their contexts. This advantage becomes particularly evident in areas like urban planning and resource allocation.

The most successful implementations combine local autonomy with network-wide coordination. This balance allows communities to address immediate needs while contributing to broader ecosystem health. Such hybrid models represent the future of effective governance.

Empowering Network Participants

True distributed systems transform passive users into active stakeholders. This shift creates powerful psychological effects - when individuals feel genuine ownership, they invest more effort in maintaining system health. Digital platforms demonstrate this principle daily through user-generated content and community moderation.

This empowerment cycle creates self-reinforcing networks. As participants gain more influence, they contribute more value, which in turn strengthens the entire ecosystem. This virtuous circle explains why distributed systems often outcompete centralized alternatives over time.

Fostering Organic Innovation

Distributed environments naturally encourage experimentation. Without centralized gatekeepers controlling development, creative solutions emerge from unexpected places. This organic innovation process frequently produces breakthroughs that traditional R&D structures might miss.

The most vibrant distributed networks implement mechanisms to surface and amplify the best ideas. Reputation systems, funding pools, and governance proposals help valuable innovations gain traction. This emergent innovation represents one of distributed systems' greatest strengths.

Digital Asset Transformation and Trading Platforms

Asset Digitization Revolution

Digital representation of physical assets marks a paradigm shift in ownership models. By converting real-world value into programmable tokens, these systems enable unprecedented flexibility. Fractional ownership becomes practical, allowing broader participation in previously exclusive markets.

The implications extend far beyond financial accessibility. Tokenized systems introduce programmable features like automated royalty distributions and usage-based billing. These capabilities could redefine entire industries, from real estate to intellectual property management.

Peer-to-Peer Trading Ecosystems

Modern trading platforms eliminate traditional intermediaries through clever protocol design. Automated liquidity pools replace order books, while smart contracts enforce trade execution. This architecture reduces counterparty risk and operational costs simultaneously.

These platforms demonstrate remarkable resilience during market turbulence. Without centralized points of failure, they continue operating when traditional exchanges falter. This reliability becomes increasingly valuable as digital asset markets mature.

Synergistic Market Effects

The combination of asset digitization and decentralized trading creates powerful network effects. Tokenized assets gain liquidity through automated market makers, while trading platforms benefit from diversified asset offerings. This symbiotic relationship accelerates ecosystem growth.

Emerging hybrid models blend the best features of both worlds. Some platforms incorporate selective centralized elements to improve user experience without sacrificing core decentralization principles. These pragmatic adaptations demonstrate the ecosystem's maturation.

Democratizing Market Access

The combined effect of these technologies significantly lowers participation barriers. Geographic restrictions become irrelevant when markets operate globally by design. Minimum investment thresholds disappear through fractional ownership possibilities.

This accessibility revolution extends beyond retail participants. Small businesses and developing economies gain access to capital markets previously beyond reach. Such broadened participation could reshape global economic dynamics in coming decades.

Human physiology demonstrates remarkable adaptability to physical challenges. Our musculoskeletal system evolves in response to demands placed upon it, developing greater resilience through controlled stress application. This biological principle mirrors how distributed systems strengthen through participation.

Evolving Financial Infrastructure

Network Growth Dynamics

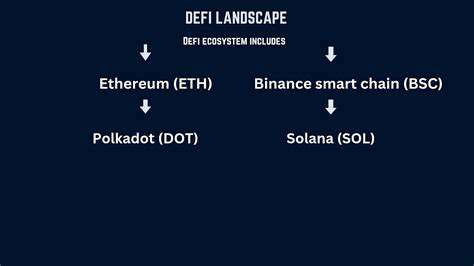

The expansion of alternative financial networks follows predictable adoption curves. Early innovators establish foundational protocols, followed by developers building complementary services. This layered growth creates increasingly sophisticated ecosystems.

Network effects become particularly powerful in financial contexts. As more participants join, liquidity increases, which attracts additional users. This positive feedback loop explains the rapid growth of successful platforms.

Security Through Design

Modern financial networks achieve security through architectural choices rather than institutional trust. Cryptographic proofs replace manual verification, while distributed consensus prevents unilateral changes. This technical foundation enables unprecedented auditability.

Such systems demonstrate that security and transparency need not conflict. Properly designed networks maintain privacy where needed while ensuring overall system integrity. This balance represents a major advancement over traditional financial infrastructure.

Global Financial Inclusion

Alternative financial systems particularly benefit underserved populations. The unbanked gain access to savings and payment tools without traditional account requirements. Cross-border transactions become affordable for migrant workers sending remittances.

This inclusion potential may represent these systems' most significant impact. By serving populations excluded from traditional finance, they could meaningfully reduce global economic inequality over time.

Product Innovation Waves

The programmability of modern financial infrastructure enables continuous innovation. Developers can combine financial primitives like lending and trading in novel ways. This composability leads to unexpected product breakthroughs.

The most successful innovations address real user needs rather than technical possibilities. Practical solutions for savings, payments, and risk management demonstrate the technology's maturity beyond speculative applications.

Regulatory Adaptation

Governments worldwide grapple with balancing innovation and consumer protection. Effective regulation requires understanding these systems' technical realities. Overly restrictive approaches risk stifling beneficial innovation while inadequate oversight leaves users vulnerable.

The most promising regulatory frameworks focus on outcomes rather than technologies. Principles-based approaches that accommodate technical evolution while protecting fundamental rights show particular promise.

Traditional System Integration

Hybrid models connecting alternative and traditional finance are emerging. These bridges allow value to flow between systems while maintaining each network's distinct advantages. Such interoperability benefits all participants.

This integration represents the next phase of financial system evolution. Rather than replacing traditional finance, alternative systems may ultimately complement and enhance existing infrastructure.